Introduction

In today’s fast-paced world, self-improvement is no longer just a goal—it’s a necessity. Whether you’re looking to boost your career, improve relationships, or adopt healthier habits, finding the right guidance can make all the difference. That’s where books come in. From presenting expert insights to offering actionable strategies, books have the power to transform how we think, live, and grow.

If you’ve been searching for the best books on Take Control of Your Finances and Build Wealth, you’ve come to the right place. The beauty of reading lies in its ability to meet your unique needs, whether you’re trying to build confidence, master emotional intelligence, or unlock new levels of creativity.

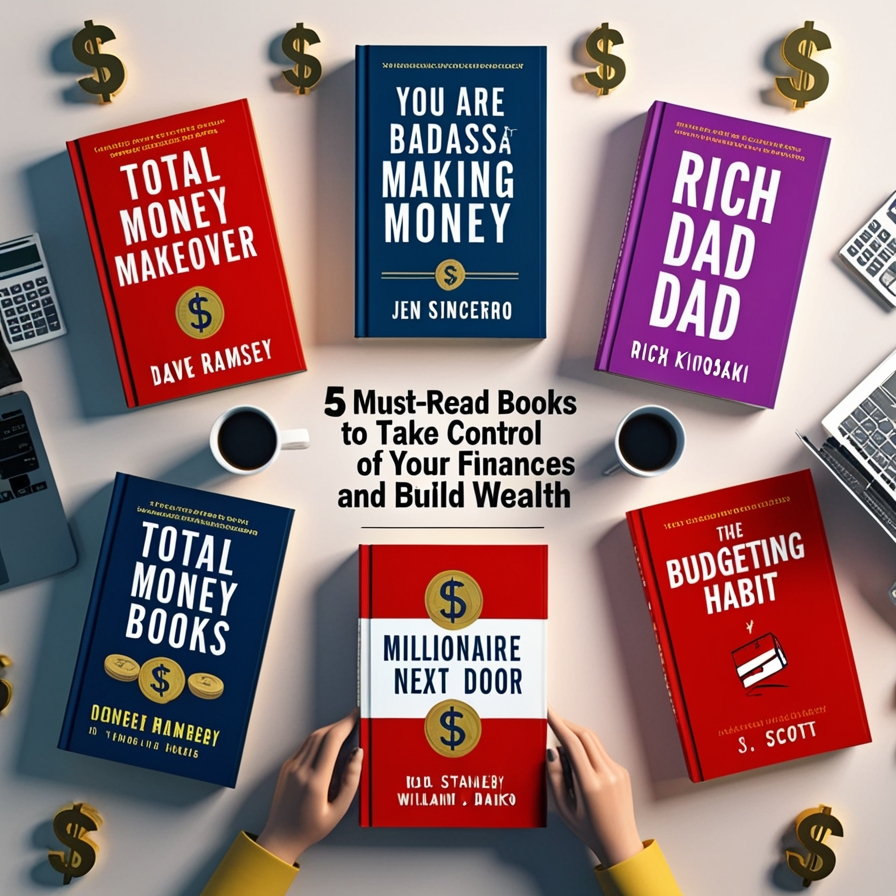

In this post, we’ll explore the Top 5 Books on Take Control of Your Finances and Build Wealth—a carefully curated list designed to inspire and empower. These books offer more than just theories; they provide practical tools to help you achieve your goals and tackle challenges head-on. Whether you’re pursuing personal growth or professional excellence, these titles have something valuable to offer.

As we dive into these books, you’ll discover:

- Expert strategies for overcoming obstacles.

- Inspiring stories to motivate and uplift.

- Tools for resilience, focus, and growth.

Ready to transform your life with the best Take Control of Your Finances and Build Wealth-focused books? Let’s dive in and explore how these must-reads can help you take the first step toward living your best life!

Book 1. The Total Money Makeover by Dave Ramsey – A Proven Plan for Financial Fitness

Overview:

The Total Money Makeover is a game-changer for anyone looking to take control of their finances. In this book, Dave Ramsey shares powerful strategies and real-life examples that guide you through the process of eliminating debt, saving money, and building wealth. Whether you’re facing challenges in your personal life or financial journey, this book offers actionable steps to help you achieve lasting financial success.

Summary:

In The Total Money Makeover, Dave Ramsey unveils a roadmap for financial freedom. Packed with practical advice, this book dives deep into proven methods for paying off debt and saving for the future. Through inspiring examples and real-life success stories, readers will discover how to make their money work for them. Whether aiming for financial independence or simply seeking to get out of debt, this book provides essential tools to achieve long-term financial health.

What You’ll Learn:

- How to get out of debt and build wealth.

- Steps to create and stick to a budget.

- The importance of saving and investing for the future.

- Effective ways to set and reach financial goals.

- How to change your financial mindset.

Why You Should Read It:

- Learn how to take control of your financial situation.

- Gain insight into creating a debt-free life.

- Practical advice for building wealth and security.

About The Author:

Dave Ramsey is a financial expert and author of multiple best-selling books. With years of experience in financial coaching, Ramsey has helped millions of individuals achieve financial freedom.

Ready to take control of your life? Get your copy of The Total Money Makeover now and start your journey toward financial freedom.

Book 2. You Are a Badass at Making Money by Jen Sincero

Overview:

In You Are a Badass at Making Money, Jen Sincero explores the essential principles of creating wealth through mastering your mindset. With practical exercises and insightful strategies, this book offers readers a clear path to financial freedom. Through relatable examples and actionable advice, it empowers individuals to overcome self-doubt and take control of their financial destiny.

Summary:

You Are a Badass at Making Money combines scientific research with real-world applications. Jen Sincero presents a step-by-step framework to help you unlock your potential and build lasting wealth. By shifting limiting beliefs and embracing an empowered mindset, readers can align their actions with their financial goals and create the life they desire.

What You’ll Learn:

- How to identify and overcome limiting beliefs about money.

- Proven techniques for building wealth and increasing income.

- Insights into the psychology of success and abundance.

- Practical strategies to implement a wealth-building mindset.

- Steps to align your financial goals with your personal values.

Why You Should Read It:

- Transform your mindset around money and wealth.

- Learn how to break free from financial limitations.

- Discover strategies to create the financial life you want.

About the Author:

Jen Sincero is a best-selling author and motivational speaker who specializes in personal development and financial empowerment. Her fun and engaging writing style has inspired thousands to take charge of their finances.

Don’t miss out on these life-changing tools! Order your copy of You Are a Badass at Making Money and begin your transformation today.

Book 3. Rich Dad Poor Dad by Robert T. Kiyosaki

Overview:

Rich Dad Poor Dad takes you on a transformative journey through the financial principles that lead to wealth. Robert T. Kiyosaki shares the contrasting lessons taught by his two father figures—his own poor father and his rich mentor. This book explores how the wealthy think differently about money and wealth-building, offering readers the tools to adopt a mindset that will lead to financial success.

Summary:

In Rich Dad Poor Dad, Robert T. Kiyosaki lays out the essential principles for financial education, including the importance of investing, entrepreneurship, and financial literacy. With practical advice and insightful stories, readers will learn how to escape the cycle of living paycheck to paycheck and build wealth.

What You’ll Learn:

- How to think like the rich and build wealth.

- The importance of financial education and investing.

- How to build passive income streams.

- Strategies to build assets that generate wealth over time.

- Insights into real estate and business investing.

Why You Should Read It:

- Learn the principles that set the wealthy apart.

- Gain a deeper understanding of financial literacy.

- Discover the mindset needed for wealth-building.

About the Author:

Robert T. Kiyosaki is a successful entrepreneur and financial educator whose books have been translated into dozens of languages. His teachings have influenced millions of readers worldwide to adopt a more empowering approach to money.

Ready to unlock your full potential? Grab your copy of Rich Dad Poor Dad now and start building your wealth today!

Book 4. The Millionaire Next Door by Thomas J. Stanley & William D. Danko

Overview:

The Millionaire Next Door reveals the habits and characteristics of America’s wealthiest individuals. Through extensive research, Thomas J. Stanley and William D. Danko discovered that many millionaires live frugally, avoid debt, and invest wisely. This book breaks down the behaviors that contribute to financial success, helping readers adopt habits that can lead to wealth.

Summary:

The Millionaire Next Door presents a comprehensive analysis of the habits and traits of self-made millionaires. It highlights the importance of living below your means, avoiding excessive spending, and making wise investments. By applying the strategies outlined in this book, readers can build long-term wealth and achieve financial independence.

What You’ll Learn:

- The financial habits of wealthy individuals.

- How to live below your means and build wealth.

- Strategies for investing wisely and making money work for you.

- How to avoid common financial pitfalls.

- The importance of financial discipline and patience.

Why You Should Read It:

- Gain insight into the wealth-building habits of millionaires.

- Learn practical tips to save and invest wisely.

- Discover how to accumulate wealth through disciplined financial practices.

About the Author:

Thomas J. Stanley and William D. Danko are experts in the field of wealth management. Their research-based approach has influenced millions of readers seeking financial independence.

Take charge of your finances and wealth today! Order your copy of The Millionaire Next Door now and start your journey to financial freedom.

Book 5. The Budgeting Habit by S.J. Scott

Overview:

If you’re looking to supercharge your financial growth, The Budgeting Habit by S.J. Scott is a must-read. This book covers the essential principles of budgeting, providing readers with practical tools to manage their money effectively. Whether you’re looking to eliminate debt, save for a specific goal, or invest for the future, this book will help you develop the habits needed for long-term financial success.

Summary:

In The Budgeting Habit, S.J. Scott explores how adopting a budgeting mindset can help you take control of your finances. The book offers easy-to-implement strategies for tracking expenses, reducing unnecessary spending, and allocating funds for future goals. Whether you’re a beginner or seasoned budgeter, this book provides insights to help you achieve your financial objectives.

What You’ll Learn:

- How to develop effective budgeting habits.

- Proven methods for tracking and managing your expenses.

- Strategies for saving money and paying off debt.

- Tools for building an emergency fund and investing for the future.

- Techniques for achieving financial goals through budgeting.

Why You Should Read It:

- Build strong budgeting habits that lead to financial stability.

- Learn how to track your money and reduce spending.

- Practical strategies to help you save, invest, and grow wealth.

About the Author:

S.J. Scott is a well-known author and expert in personal finance and productivity. He has written several books to help people improve their financial habits and achieve success.

Start your journey toward financial security today! Grab your copy of The Budgeting Habit and take control of your finances!

FAQs About Personal Finance & Budgeting Books:

- What makes these books so special?

These books are selected because they provide practical strategies, real-world examples, and actionable steps that can help you take control of your finances. Whether you’re paying off debt or saving for the future, these books offer the tools you need to succeed. - How can I use these books to improve my financial life?

By following the advice and exercises in these books, you can start budgeting, eliminating debt, and saving more efficiently. The key is consistency and implementing the strategies in your daily life. - Are these books suitable for beginners?

Yes, these books are written in accessible language and provide clear, actionable steps for people at any financial stage. Whether you’re a beginner or looking to refine your existing knowledge, these books have something valuable to offer. - Can these books help me in my career?

Absolutely! Many of these books focus on wealth-building principles and mindset shifts that can benefit both your personal and professional life. Understanding money management is key to making smart career decisions and investments. - Where can I purchase these books?

All of these books are available on Amazon. Click the links provided to grab your copy and start transforming your financial life. - What are the top 10 most read books?

- Harry Potter series – J.K. Rowling 44% off

- The Lord of the Rings – J.R.R. Tolkien -54% off

- The Alchemist – Paulo Coelho -35% off

- The Da Vinci Code – Dan Brown -39% off

- Think and Grow Rich – Napoleon Hill -22% off

- 1984 by George Orwell -66% off

- Pride and Prejudice – Jane Austen -42% off

- To Kill a Mockingbird – Harper Lee -43% off

- The Little Prince – Antoine de Saint-Exupéry -28% off

- Don Quixote – Miguel de Cervantes -30% off

Conclusion

If you’re ready to take charge of your finances, the Top 5 Books on Take Control of Your Finances and Build Wealth offer the insights, strategies, and motivation you need. Whether you’re looking to eliminate debt, increase your savings, or invest for the future, these books provide practical advice to help you achieve your financial goals.

By implementing the lessons from these must-read books, you’ll be on your way to mastering your financial destiny and creating the life you’ve always dreamed of. Start reading today, and take the first step toward financial freedom!